Recent Trends in Media Rights Monetisation by Government and Public Bodies

3 min read

Recent Trends in Media Rights Monetisation by Government and Public Bodies driving new revenue through digital, broadcast, and auction models.

Media rights monetisation has become a vital revenue driver across industries, but increasingly government and public bodies are taking bold steps to modernise how these rights are valued and exploited. In an age of digital transformation and expanding content distribution channels, the way public institutions manage media rights is evolving rapidly. This article explores the recent trends in media rights monetisation by government and public bodies, why they matter, and how they’re reshaping public sector revenue structures.

What Are Media Rights and Why They Matter

Media rights refer to the permissions granted to broadcast, stream, or publish content through different media channels. Traditionally, these rights have been associated with sports, cultural events, and public service broadcasting. For governments and public bodies, media rights represent both a tool for public engagement and a potential source of revenue.

For example, broadcasting parliamentary proceedings or cultural festivals can enhance transparency and civic engagement. Likewise, national sporting events often attract broad audiences and significant commercial interest. However, until recently, many public bodies struggled to effectively monetise these rights due to outdated systems and limited commercial expertise.

Shift Toward Digital Platforms and Streaming

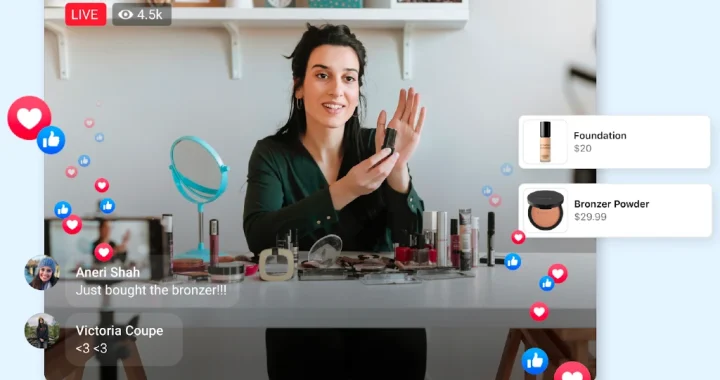

One of the most significant trends in media rights monetisation by government and public bodies is the shift toward digital platforms and streaming services. Unlike traditional broadcast media that relied on fixed schedules and limited channel distribution, digital platforms allow content to reach global audiences instantly.

Consequently, governments are now licensing media rights not just to national broadcasters but also to online platforms with broad reach. These digital deals often generate higher revenue due to competitive bidding and the ability to offer targeted advertising. Additionally, digital distribution enables data insights, helping public bodies understand audience patterns and refine monetisation strategies over time.

Auction-Based and Competitive Bidding Models

Another emerging trend is the adoption of auction-based models and competitive bidding for media rights sales. Previously, rights were often granted on a direct-negotiation basis with incumbent broadcasters. However, governments are increasingly inviting open bids to attract competitive offers.

This approach has multiple advantages. Firstly, it increases transparency in public contracting. Secondly, it allows public bodies to secure fair market value for their media rights. For instance, countries hosting national events or international sports tournaments are now conducting digital and broadcast rights auctions, inviting both traditional broadcasters and digital platforms to participate.

Partnerships with Private Sector Innovators

Government and public bodies are also forming strategic partnerships with private sector companies that specialise in content distribution and monetisation. These collaborations help public institutions leverage private sector expertise in digital rights management, advertising sales, and subscription models.

With such partnerships, governments can focus on content creation and public service mandates while private partners drive revenue generation. For example, some public broadcasters now co-produce content with commercial entities, sharing revenue and distributing content across multiple platforms.

Use of Data Analytics and Audience Insights

Modern media rights strategies increasingly rely on data analytics to maximise value. Government and public bodies are adopting sophisticated tools to track viewership patterns, engagement metrics, and demographic trends. These insights not only help set realistic pricing for media rights but also enable targeted advertising and sponsorship deals.

For example, by understanding peak viewing times and popular content segments, public bodies can offer more attractive packages to advertisers. This data-driven approach is pivotal in creating dynamic pricing models that reflect real-time demand.

Balancing Commercialisation with Public Service Mandates

While monetisation presents financial opportunities, government and public bodies must balance commercial goals with their public service responsibilities. Unlike purely commercial entities, these organisations have mandates to ensure access, inclusivity, and dissemination of information. Thus, while rights may be sold to private broadcasters or platforms, provisions often ensure free or affordable access for citizens.

This balance is especially important for educational content, legislative coverage, and cultural programming that serve the public good rather than commercial interests alone.

Future Outlook: Innovation and Regulation

Looking ahead, the landscape of media rights monetisation by government and public bodies will continue to evolve. With technologies like AI-driven content recommendation, blockchain for rights tracking, and interactive media, the opportunities for monetisation are expanding. However, regulatory frameworks will also need to evolve to protect public interest and ensure fair competition.

In conclusion, governments and public bodies are rapidly modernising how they manage and monetise media rights. By embracing digital platforms, competitive bidding, strategic partnerships, and data analytics, they are unlocking new revenue streams while continuing to fulfil their public mandates.